Uncommon Sense

September 2025 – Newsletter

For many people, September feels like a fresh start. Perhaps it’s those years of back-to-school conditioning, but there’s something energising about this time of year. As we head towards the final quarter, it’s natural to reflect on where we are and what we’d like to accomplish before the end of the year.

Whether you’re considering financial goals, family priorities, or how you want to spend the remaining months of 2025, this is an excellent time for reflection.

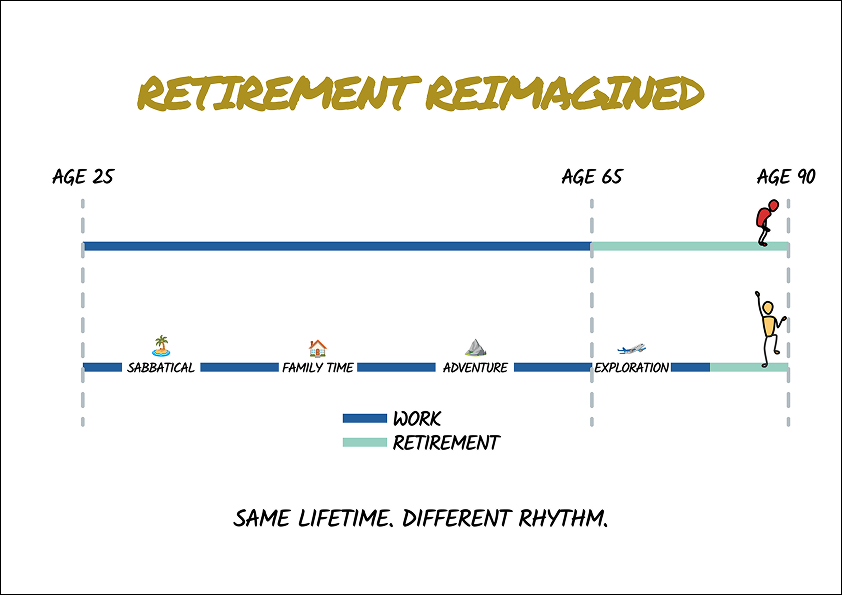

Enjoy this month’s instalment of our newsletter. It is packed with ideas and links that you may find interesting. As always, we’re here if you’d like to discuss how any of these ideas might apply to your unique situation. One of our favourites this month is the Retirement Reimagined article, which you’ll find later in this newsletter.

📰 Read

Optimising Ourselves to Death [4 minutes]. Is the relentless pursuit of optimisation in our lives creating more anxiety than productivity, and is it time to embrace the beauty of imperfection instead?

Little Rules About Big Things [8 minutes]. Little-known truths about wealth, risk, and human behaviour.

The Riddle of Happiness [3 minutes]. What if the relentless pursuit of happiness is actually the very thing that keeps it just out of reach?

The Noise Factory [7 minutes]. Learn how to cut through the chaos and make investment decisions that truly matter.

Want to Live Longer? You Better Start Moving – All Day Long [4 minutes]. The surprising key to longevity that goes beyond traditional health metrics.

🎧 Listen

Big Ideas From The Art of Spending [11 minutes]. How the art of spending money can reshape your financial mindset.

The Stock Markets

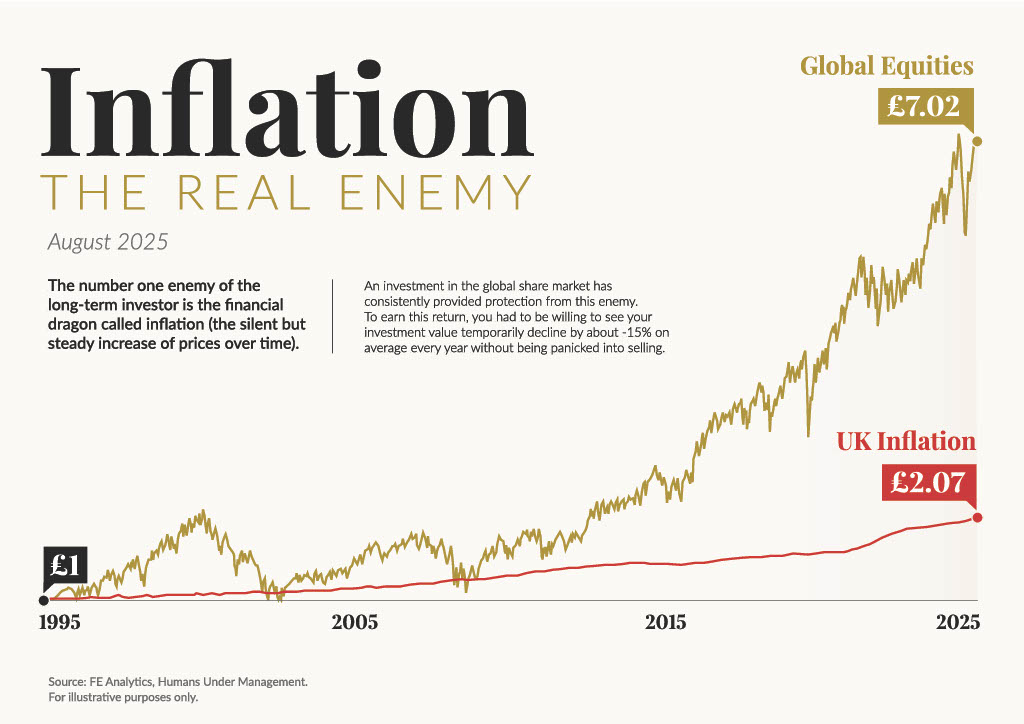

Inflation – The Real Enemy

🖼️ A Picture is Worth a Thousand Words

Share of the World’s Countries by Income

The 10 Most-Used AI Chatbots in 2025

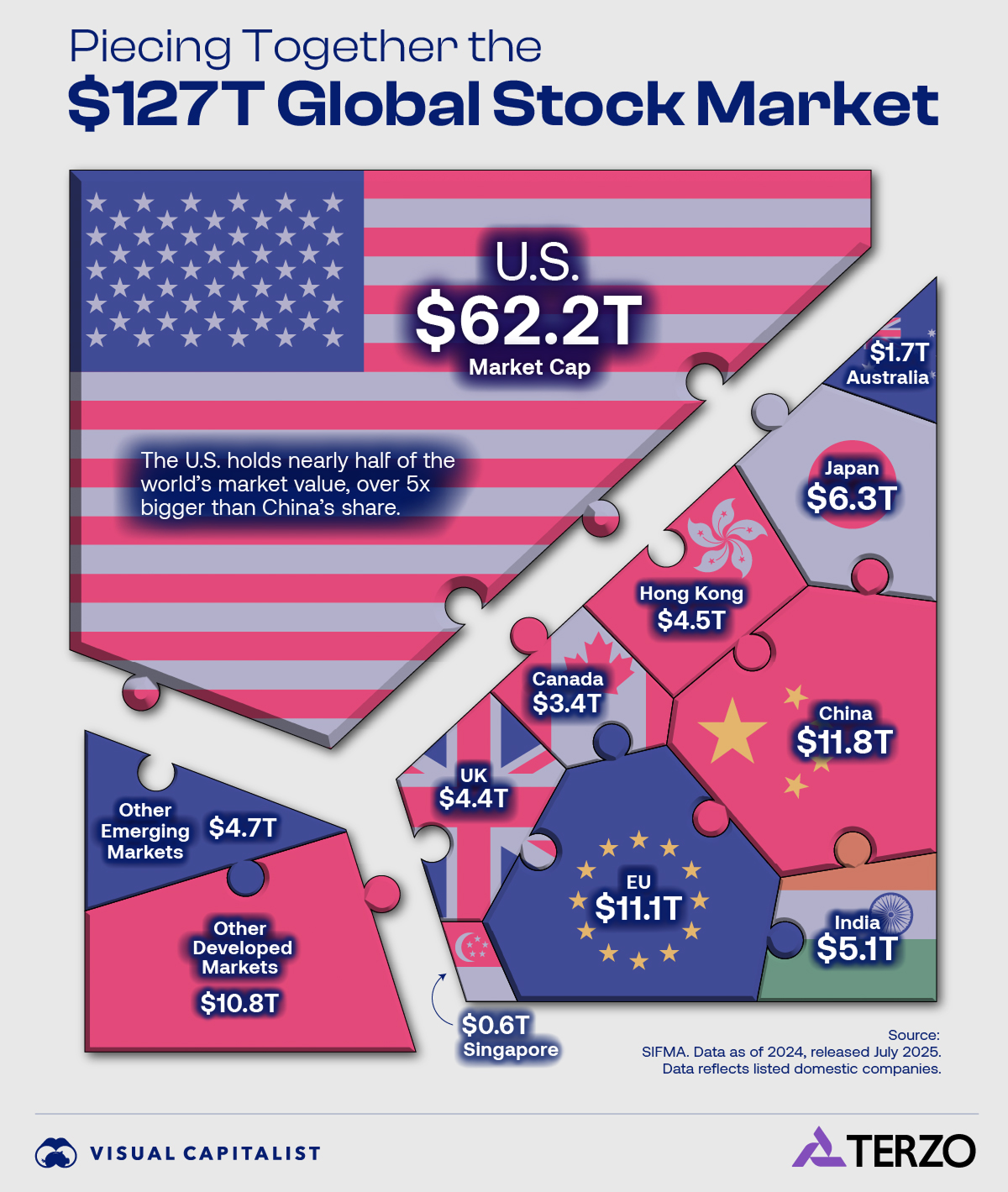

The $127 Trillion Global Stock Market in One Giant Chart

Retirement Reimagined

Retirement as we know it is barely 150 years old. Otto von Bismarck introduced the world’s first state pension in Germany in 1889, setting the retirement age at 70, an age that only a minority of the population actually reached.

The concept was simple: work until you could no longer physically do so, and then society would care for you in your final years.

That world no longer exists. The forces reshaping how we live and work are so fundamental that the retirement of the future is unlikely to resemble the retirement of the past. The question isn’t whether retirement will change, but how quickly we can adapt our thinking to match this new reality.

For the first time in history, we have the tools and longevity to completely reimagine what the later decades of life could look like.

The Forces Reshaping Everything

Several powerful trends are making traditional retirement planning obsolete.

Longevity has exploded. Today’s 65-year-old couple has a 50% chance that at least one spouse will live to 92. Today’s retirees are looking at 25- to 30-year retirements, not the 10-year periods our grandparents planned for.

Health spans are extending. People aren’t just living longer, they’re staying active much deeper into their lives. Many 70-year-olds today have the energy that 50-year-olds had a generation ago.

The workplace has been revolutionised. People change jobs every 4-5 years and switch careers multiple times. Remote work has made location independence possible for millions, and the gig economy enables flexible arrangements that were previously unimaginable.

Technology has eliminated barriers. You can work from anywhere, manage your life from your phone, and stay connected regardless of geography. The infrastructure that once tied us to specific locations has largely disappeared.

These changes are unlikely to be temporary. It’s more likely that they are permanent shifts requiring us to rethink how we structure our lives fundamentally.

What the Future of Retirement Could Look Like

The forces explored above mean that life no longer needs to follow the patterns of the past. Instead of working until 65 and then stopping completely, consider a more flexible approach that leverages these new realities.

While these possibilities were not an option for the previous generation, they will be options that future retirees will have the luxury to consider.

Periodic sabbaticals throughout your career. Take 3-6 month breaks every few years to recharge, pursue passions, or spend concentrated time with family. Remote work makes this increasingly feasible.

Strategic family time. Rather than missing your children’s childhood, consider taking a year off when they’re young to travel together or be fully present in their daily lives. Those memories can’t be recaptured later.

Extended exploration periods. Take that year abroad at 45 when you have the energy to embrace the adventure. Test whether your retirement dreams match reality.

Shorter traditional retirement. By taking breaks throughout your life, you stay energised and can potentially work longer. Instead of 30 years of full retirement, work until 75 with a much shorter final retirement, having already lived many dreams along the way.

Those who take periodic breaks throughout their career may arrive at retirement with a much clearer vision of how they want to spend their later years than someone who worked nonstop for 40 years.

Planning for Multiple Possibilities

Research shows that we’re not very good at knowing what our future selves will want. The only way to see how you’ll feel about unstructured time, different locations, or various lifestyle arrangements is to test them.

For those who want to embrace the changing forces shaping our world, we have the following suggestions: Start small. Plan a two-month sabbatical. Try working remotely from a different city for a month. Experiment with part-time consulting in a field you’re curious about.

More importantly, start building these possibilities into your financial planning. Instead of just saving for one big retirement, consider creating separate funds for periodic sabbaticals, location experiments, and extended family time. The monetary cost of these experiments is often much less than the lifetime value they provide.

If the future of retirement is expected to be more flexible, health-conscious, and globally connected, your financial plan should reflect these possibilities. We’re here to help you align your investment strategy with whatever vision of the future most excites you.

😀 Rational Optimism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

For Some Patients, the “Inner Voice” May Soon Be Audible

Remote Work Comes to Piloting Ships

Adaptation to Heatwaves in Europe Outpaces Climate Change

🍿 Watch

Predictably Irrational – Basic Human Motivations

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

As always, we’re here for you.

See you next month,

Halcyon Financial Planning