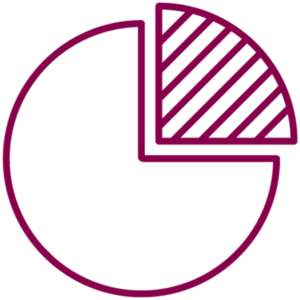

If you’ve just bought a property, it’s tempting to feel that you own the whole thing, but research5 shows that in effect, the average first-time buyer in many parts of the country probably just owns the kitchen and a bathroom when they first move in. That’s because in many cases you may not have much equity in your home, especially if you’re a first-time buyer.

SECOND STEPPING

If you have been paying off your mortgage for several years, and house prices have risen or remained stable, you will by this time own more of your property. By the time you are ready to make your next move, you’ll need to work out how much equity you now have. So, for example, if your home is valued at £275,000 and your outstanding mortgage is £100,000, then your equity, the amount of the value of your home that you truly ‘own’ is roughly £175,000.

Having more equity can mean that you will be able to obtain a mortgage on your next property at a more favourable rate of interest.

5MoneySuperMarket, 2018

A mortgage is a loan secured against your home or property. Your home or property may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.