Uncommon Sense

October 2025 Newsletter

October has arrived, bringing shorter days and the familiar rhythm of autumn in the UK. Later this month, the clocks go back, marking the official start of darker evenings. It’s a natural time to pause, reflect on the year behind us, and prepare thoughtfully for what lies ahead.

This month, we’re revisiting a lesson from last year’s budget cycle. With another budget announcement approaching and speculation filling the headlines, it’s worth remembering what we learned twelve months ago: patience beats panic, and facts beat speculation.

Enjoy this month’s instalment of our newsletter. It is packed with ideas and links that you may find interesting. As always, we’re here if you’d like to discuss how any of these ideas might apply to your unique situation.

😀 Rational Optimism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

Waymo’s Most Serious Crashes Are Rarely Waymo’s Fault

Apple Introduces AirPods Pro 3 with Live Translation Feature

Global Child Poverty Has Been on a Steady Decline Since 2014

📰 Read

How to increase your surface area for luck [5 minutes]. The more you engage with the world, the more chances you have to discover valuable collaborations and experiences.

Life Isn’t a Spreadsheet [3 minutes]. True fulfilment comes from experiences, relationships, and moments that bring joy and meaning, rather than just financial calculations.

The Powerful Thinking Skill Nobody Ever Taught You [5 minutes]. Avoiding mistakes and thinking in terms of what could go wrong is crucial for successful investing.

You Need to Be Bored. Here’s Why. [4 minutes]. Embracing boredom can lead to greater self-reflection and a deeper understanding of life’s meaningful questions.

The Riddle of Rest [5 minutes]. True rest allows for a genuine experience of peace and presence in the moment.

Golden Lessons [2 minutes]. The children’s book that serves as a timeless parable about human behaviour.

🍿 Watch

Berkshire Hathaway Board Member on Why Behaviour is So Important for Investors.

2025 Budget Speculations

Here we go again.

After much speculation about what would be included in last year’s 2024 Budget, recent reports suggest significant changes await us in this year’s Budget.

If you believe what you read, the changes could affect anything from capital gains tax, inheritance tax, pensions and maybe even ISAs.

While investors are left wondering whether they should act now or wait, the good news is we’ve been here before. Last year, we faced similar uncertainty and widespread speculation about dramatic pension reforms, inheritance tax overhauls, and sweeping allowance reductions.

Our guidance was simple: wait for facts, not speculation.

How did that work out? Some feared changes didn’t materialise, and others were less dramatic than predicted. Capital gains tax rates increased from 10%/20% to 18%/24%. Stamp duty surcharges increased from 3% to 5%. But the biggest actual change – pensions entering inheritance tax from 2027 – wasn’t even widely predicted.

Investors who avoided hasty decisions based on speculation were better positioned than those who reacted to every rumour.

This Year’s Speculation

Current reports suggest the Treasury will be looking to find an extra £30 billion in tax rises.

The chancellor will be incentivised not to breach any manifesto pledges, and therefore income tax, VAT, and National Insurance appear to be safe from reforms.

This leaves room to generate the necessary revenue through adjustments to capital gains tax rates, pension reforms, changes to inheritance tax rules, restructuring of the ISA allowance, and various property tax adjustments. However, even this narrowed-down list does not provide enough information to base any firm recommendations on.

The same problem, therefore, remains. We don’t know the details, timing, or even whether these changes will happen. Speculation often misses the mark while creating unnecessary anxiety. Political and economic realities change quickly.

Why “Wait and See” Is Still Sensible

Last year proved that reacting to speculation rather than facts typically leads to poor decisions. Waiting for official announcements means you can base decisions on actual proposals, understand the real impact on your situation, and avoid unnecessary complications.

For now, our recommendation is to focus on what you can control. Review your current arrangements to ensure you’re using existing allowances and reliefs. Above all, we suggest avoiding significant changes based solely on media rumours.

Last year’s patience served our clients well. This year, despite more intense speculation, the same principle applies.

When the budget is announced, we’ll have facts to work with. Until then, patience beats panic, and facts beat speculation.

🎧 Listen

Playing Your Own Game [20 minutes]. When you focus on yourself, the noise disappears.

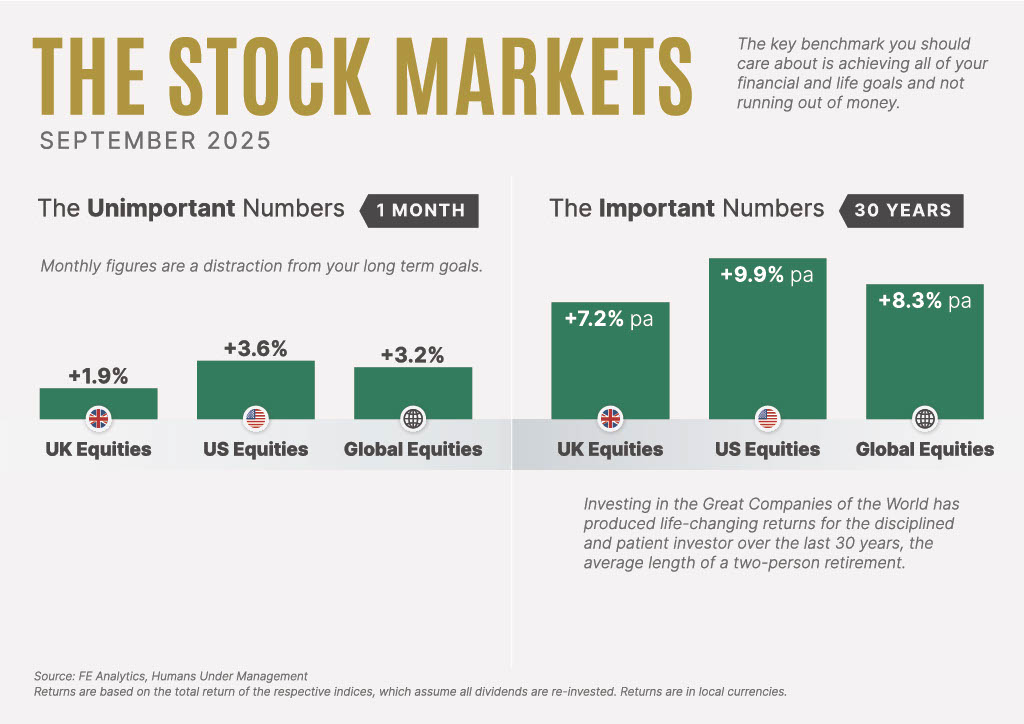

The Stock Markets

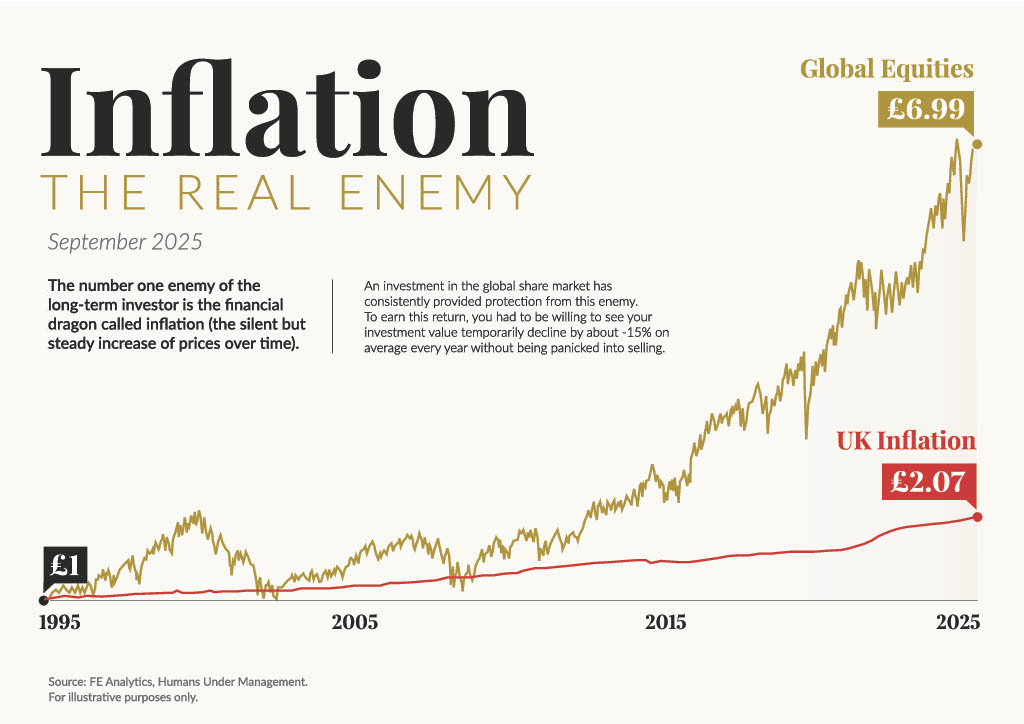

Inflation – The Real Enemy

🖼️ A Picture is Worth a Thousand Words

Why Rare Earths Are Critical to EV Motors

Sinking Fertility Rates in the World’s 10 Largest Countries

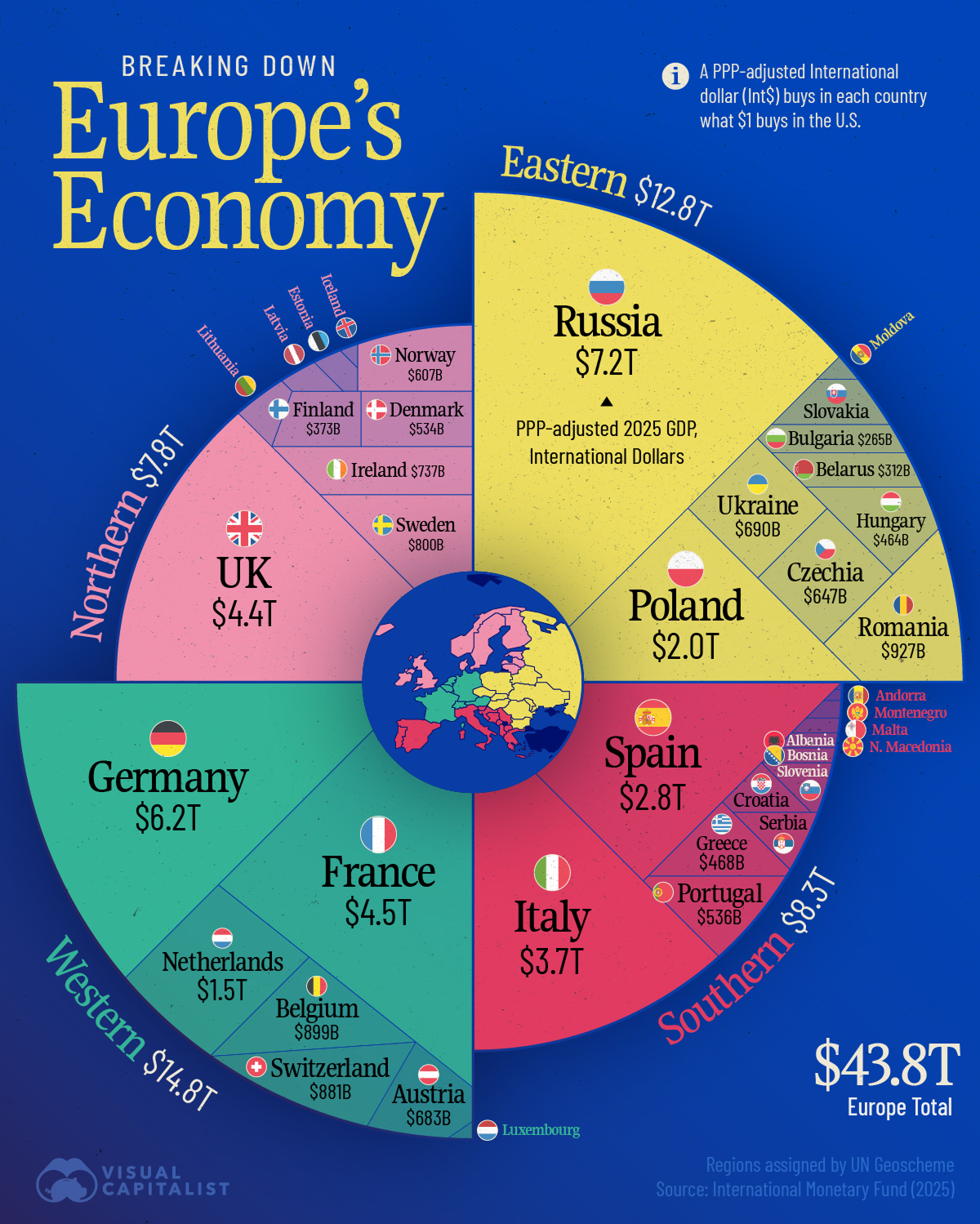

The Size of European Economies by GDP in 2025

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

As always, we’re here for you.

See you next month,

Halcyon Financial Planning