Uncommon Sense

November 2025 Newsletter

November always feels like a pause between seasons. The rush of summer behind us, the festive buzz still to come. The clocks have changed, the air’s a little colder, and it’s the perfect time to take a breath and check in on how things are tracking personally and financially.

Enjoy this month’s instalment of our newsletter. It is packed with ideas and links that you may find interesting. As always, we’re here if you’d like to discuss how any of these ideas might apply to your unique situation.

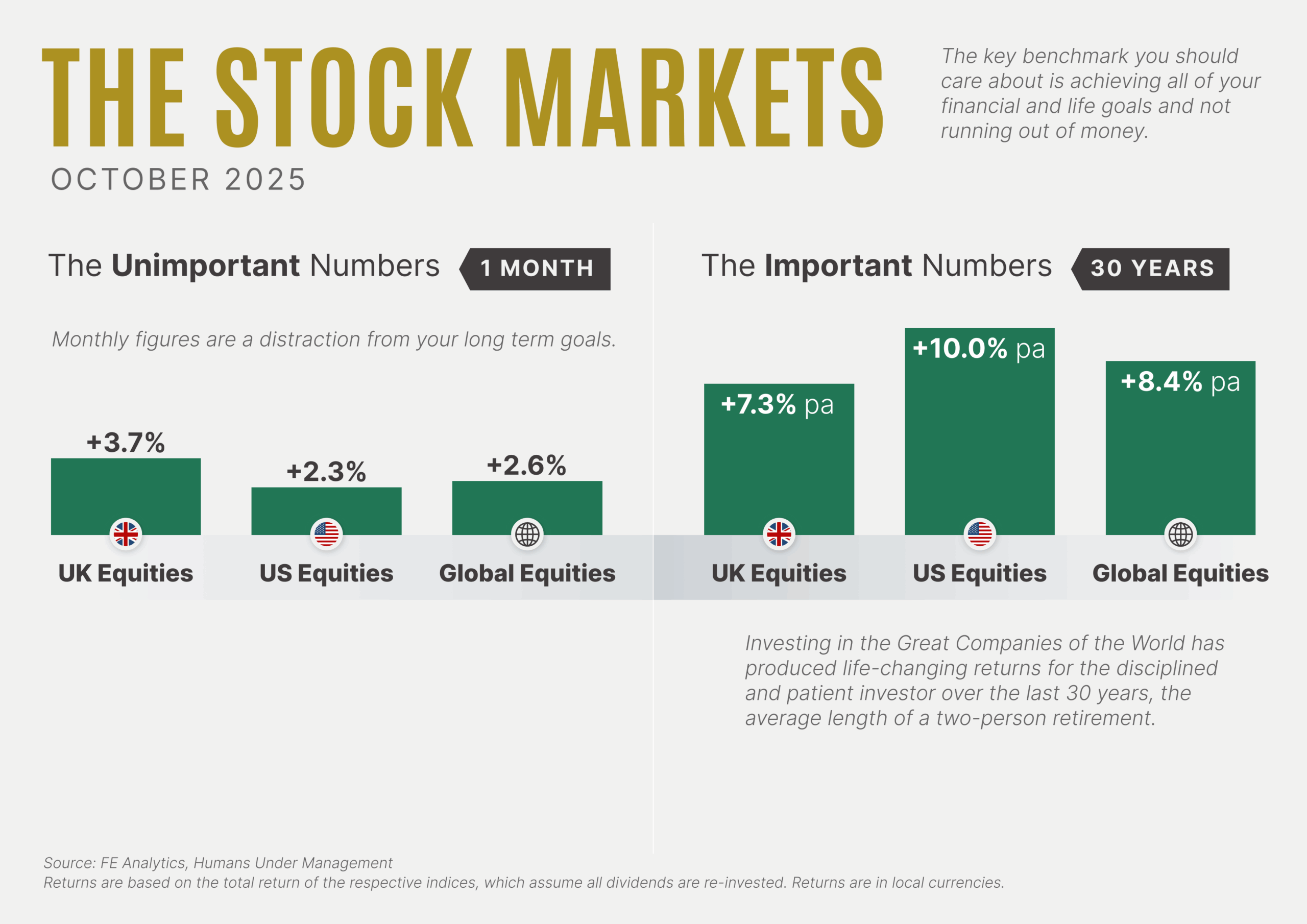

The Stock Markets

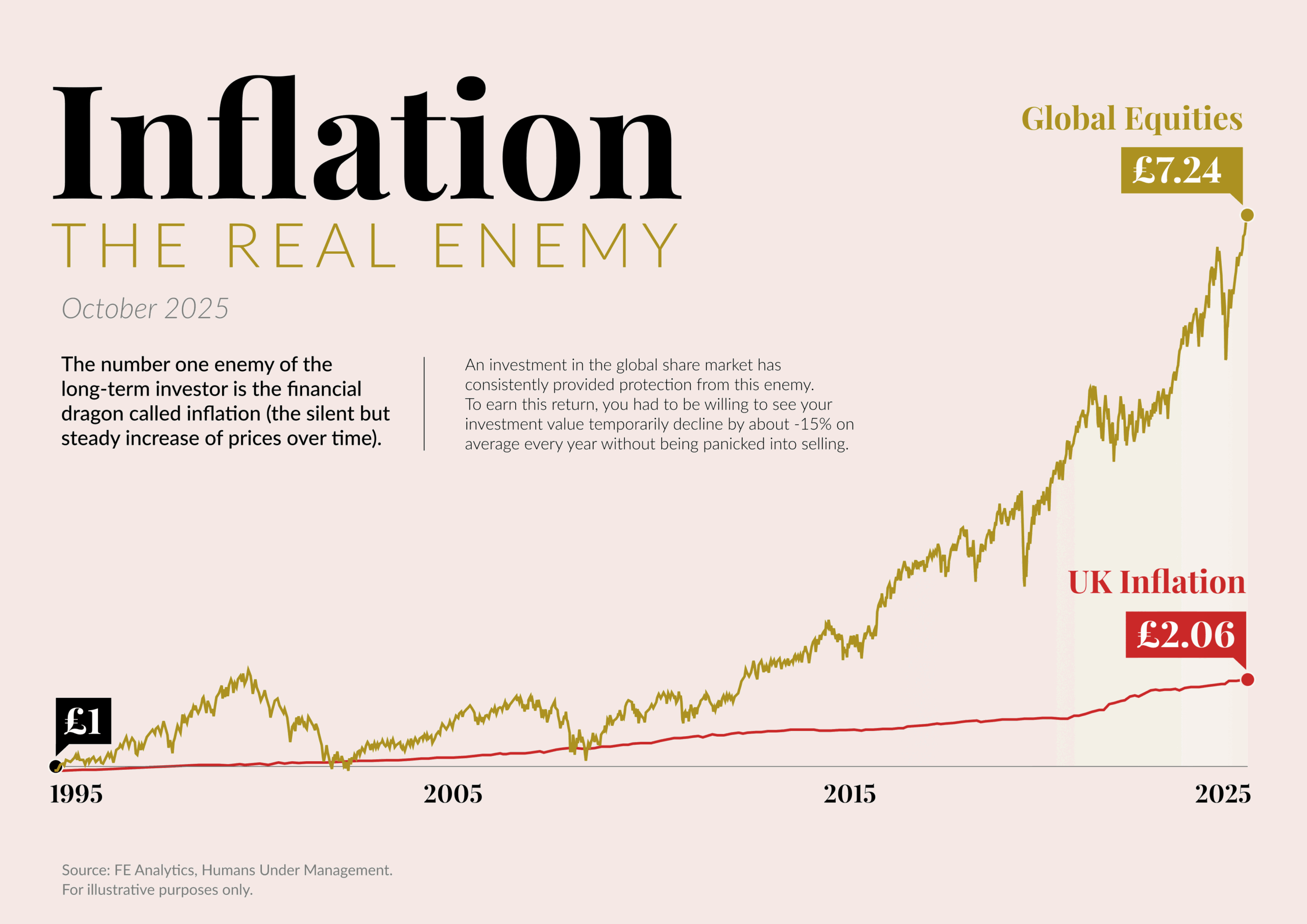

Inflation – The Real Enemy

🍿 Watch

How the Scarcity Loop is Used to Hijack Our Attention

📰 Read

Just Stay Out of Trouble [7 minutes]. Taking the time to pause and reflect before acting can prevent regret and emotional turmoil..

If You Think You’re Too Smart to Get Scammed, Read This [5 minutes]. Scammers can target anyone, including intelligent and financially savvy individuals.

What True Wealth Looks Like [5 minutes]. Money can enhance happiness when it is not pursued for social comparison or self-worth.

Does Work-Life Balance Make You Mediocre? [4 minutes]. The secret to extraordinary success, or a path to burnout and mediocrity?

If You Get the Chance [4 minutes]. Every chance is a valuable moment to practice and improve your skills.

Wealth for Yourself vs. Wealth for Others [4 minutes]. True fulfilment comes from using resources to improve the lives of others.

🖼️ A Picture is Worth a Thousand Words

Nuclear Power Capacity by Country (2025)

Visualising the Top 10 Global Risks (2020-2025)

The World’s Population by Generation

🎧 Listen

Your Future Self [3 minutes]. Are they a stranger?

The Prophets of Doom

Something deep in human nature makes us lean in when we hear whispers of danger on the horizon.

Throughout history, prophets of doom have commanded our attention, warning of catastrophes only they could foresee. In our age, these prophets have traded robes for business suits, swapping predictions of divine wrath for forecasts of market collapse. Their stages are now financial networks, their scrolls replaced by charts, but their message remains unchanged: devastation approaches, and only they saw it coming.

After three years of solid market returns, they’re back with familiar predictions. The same faces, the same warnings, year after year. Market history is filled with predictions that didn’t materialise as forecast, yet somehow we still find ourselves drawn to listen.

Perhaps you’ve felt it yourself, that flutter of anxiety when a confident expert declares the party is over. Unfortunately, when predictions don’t pan out, we forget. When they occasionally align with reality, that single success becomes legendary. And so the cycle continues, with each new market high bringing fresh warnings of imminent collapse.

Why Doom Sells (And Why We Buy It)

Our ancestors survived by overreacting to threats. Missing one danger could be fatal. Missing one opportunity just meant waiting for another. But times have changed. Our portfolios don’t face sabre-toothed tigers, and market volatility isn’t a survival threat; it’s a normal feature of financial markets.

Perhaps the problem is that pessimism sounds protective, and optimism sounds like a sales pitch. The prophets position themselves as our caring protectors, so why wouldn’t we listen?

The warning about AI bubbles today sounds remarkably similar to those who warned about the internet bubble in the 1990s. They were “right” eventually, but investors who listened missed years of extraordinary gains before the correction finally came and were scared out of owning great companies that are still around today.

Corrections of 10-20% occur regularly, so we understand that markets will decline again. The real risk of the forecasts is the certainty with which these prophets claim to know exactly when and by how much.

Yet despite all we know about how markets behave, each new wave of warnings still finds an audience. History repeats itself, not through the events, but through our reactions to them.

The Real Cost of Listening

Even when warnings about a downturn contain some truth, reacting to them can still do more harm than good. Investors who change course at the first sign of trouble often upset a carefully designed portfolio, lock in losses, and miss the subsequent recovery.

Markets move in cycles, but those cycles rarely unfold in a straight line. Trying to sidestep every decline usually means mistiming both the fall and the rebound.

The greater danger lies in breaking the long-term discipline that successful investing requires. A single reaction, made in fear or overconfidence, can undo years of steady progress. Rebuilding that confidence and structure later is far harder than holding it through a temporary decline.

Those who try to outguess events are left chasing the next move, always reacting instead of progressing. But financial markets reward patience and planning, not prediction. Every decision to stay the course, to rebalance rather than retreat, and to trust a sound process instead of a headline, strengthens the foundation for lasting wealth.

Turning Fear into Focus

The next time you come across a confident prediction of an impending crisis, pause and remember: not everyone in the financial world is playing the same game. The commentators on television, the traders chasing short-term moves, and the long-term investor building wealth over decades each have different goals. What feels urgent to them is often utterly irrelevant to you.

Your game unfolds over years and decades, not weeks. The purpose of your plan is not to predict what happens next, but to guide decisions that create security and freedom over time. That perspective lets you filter information instead of reacting to it.

When the next prophecy of doom appears, let it sharpen your focus rather than feed your fear. Remember what truly matters: a sound plan, steady saving, and patience through market cycles. Those are the real defences against uncertainty.

We are here to help you play your game well and stay confident, no matter what the markets bring.

😀 Rational Optimism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

The Zipper Is Getting Its First Major Upgrade in 100 Years

Nobel Prize Win Buoys Business Case for Creating Water from Air

Austria and Italy Finish Digging World’s Longest Rail Tunnel

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

As always, we’re here for you.

See you next month,

Halcyon Financial Planning