Uncommon Sense

August 2025 – Newsletter

Enjoy this month’s instalment of our newsletter. As always, it is packed with links that you may find interesting, a downloadable copy can be found via this link Halcyon’s Uncommon Sense – August Newsletter

📰 Read

The Opportunity Cost of Everything [14 minutes]. The most valuable currency in life isn’t money, but the choices you make with your time.

Under the Influence [19 minutes]. What if your biggest desires were never truly yours to begin with?

Do What Matters: A Framework to Invest and Live Better [5 minutes]. Examining what truly counts.

Pedalling Away From Tightness [3 minutes]. Permission to enjoy life might be your best retirement plan yet.

Being Human Means Being a Bad Investor [3 minutes]. The intriguing ways our human nature affects our investment decisions.

Now You Get It [5 minutes]. What if everything you thought you knew about success and loss was turned upside down by the reality of firsthand experience?

🍿Watch

The Secret to Happiness with Harvard professor Robert Waldinger

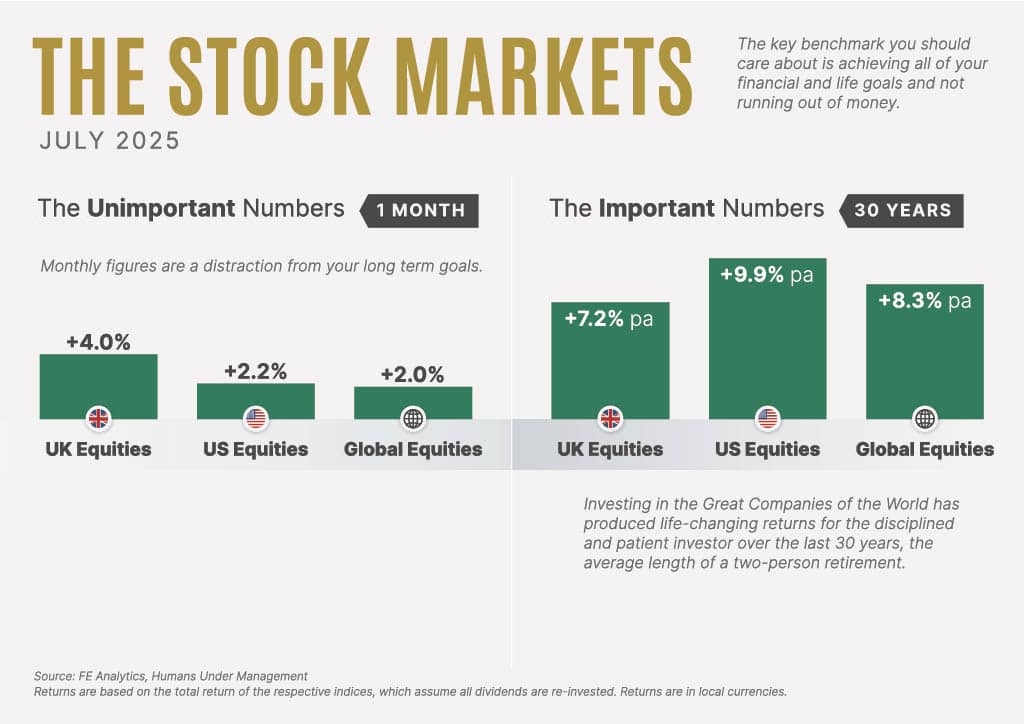

The Stock Markets

🎧 Listen

Life Meets Money [4 minutes]. What really drives good financial decisions?

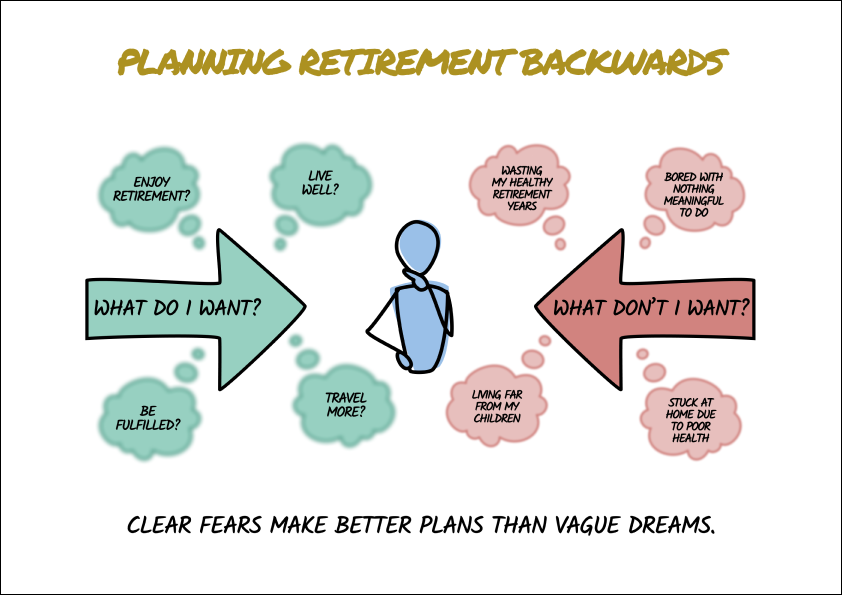

Thinking Backwards: A Different Way to Plan Your Retirement

Most people plan their retirement by looking forward, trying to envision their perfect future. “What do I want to do? Where do you want to live?” Unfortunately, most people have no idea what they want.

Ask someone to describe their ideal retirement and you’ll get vague answers. “Travel more.” “Spend time with family.” These sound nice, but they’re not specific enough for planning.

Here’s a different approach that gets you better answers much faster: start with what you don’t want. This comes from Charlie Munger, who made “invert, always invert” one of his core principles. Instead of asking “How do I succeed?” consider asking “How do I fail?” and then work to avoid those outcomes.

When you ask, “What would make my retirement miserable?” the answers come quickly. These fears are specific and actionable. Avoiding them brings you remarkably close to the life you want.

The Overlooked Mistakes to Avoid

The financial regrets of retirement get all the attention. Not saving enough, retiring too early, and underestimating costs are common financial pitfalls. Most advisers typically cover these areas well.

We believe four lifestyle mistakes can ruin your retirement, even if your money is sorted.

Missing your active window.

Most people have roughly 15 years of healthy, mobile retirement before things get harder. Yet many waste these precious years because they didn’t plan for travel and adventure while they could still enjoy them.

Losing your identity and purpose.

After 40 years of career structure, many retirees feel completely lost. They have money, but it lacks a sense of usefulness or meaning. The days feel empty because work provided more than just income.

Relationship isolation.

Some retirees find themselves living far from adult children and grandchildren, or they’ve let friendships fade during busy career years. Money can’t buy back lost time with people you love.

Neglecting health in your 50s and 60s.

This is when prevention matters most. Poor health choices during these years can significantly reduce the quality of your entire retirement, regardless of how much money you have saved.

All of these issues can be avoided entirely through proper planning.

How to Apply Inversion Thinking to Your Retirement Planning

While most people do post-mortems after something goes wrong, a “pre-mortem” imagines failure before it happens. It’s simpler than it sounds.

Begin by imagining you’re 80 years old, reflecting on your retirement with profound regret. Ask yourself: “What went wrong?”.

What do you wish you’d done differently? Don’t overthink this. Your gut reactions are usually the most telling. Write down everything that comes to mind, no matter how obvious it seems.

Next, get specific. Instead of “I wish I’d travelled more,” ask “Where exactly did I want to go, and when was the best time to do it?” Instead of “I should have stayed healthier,” ask “What specific health habits would have made the biggest difference?”

Then work backwards to today. For each regret, identify what you need to start doing now to prevent it. If your biggest fear is losing touch with your children, consider where you’ll live in retirement. If you’re worried about losing your sense of purpose, consider developing interests beyond work.

The goal isn’t to solve everything today; it’s about gaining clarity on what matters to you, so you can begin incorporating those elements into your plan. This exercise may take 30 minutes, but it can save you decades of regret.

Your Next Step

Most retirement advice focuses on the numbers. How much to save, when to retire, how to invest. These are important, but they’re not enough.

The retirement that will bring you fulfilment requires thinking beyond the spreadsheet. It requires imagining not just the money you’ll have, but the life you’ll live with it.

Inversion thinking gives you a practical way to do this. The pre-mortem exercise we described isn’t a one-time activity. Your fears and priorities will change as you get closer to retirement. What feels important at 50 might look different at 60. Regular check-ins help you stay on track.

The financial piece of retirement is well understood. Do the work now to avoid the lifestyle regrets later. If you’d like help applying this thinking to your specific situation, we’re always here to guide you through the process.

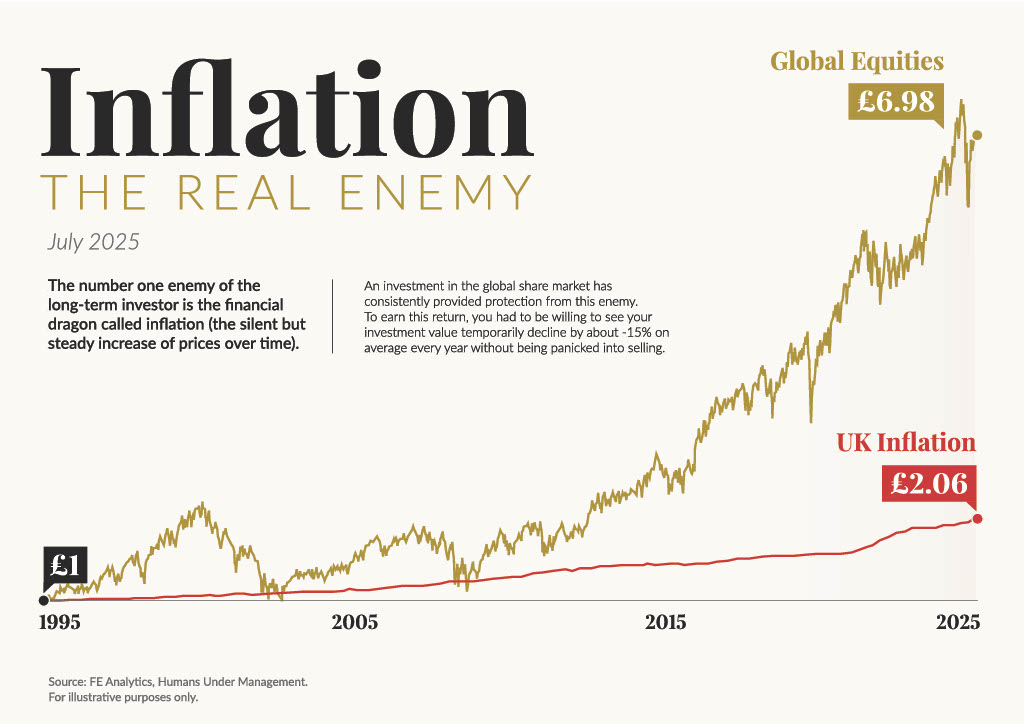

😀 Rational Optimism

The media is not a friend of the disciplined and patient investor. Ignoring the key determinants of lifetime investor returns, the media focuses on short-term returns, market predictions, and negative news.

We present the following as an antidote to the onslaught of negative news:

In Praise of Obsolescence: The Hidden Wealth in Products That Break

Google AI Tool That Fills Missing Words in Roman Inscriptions

Drones Carry 180 Tonnes of Steel and Concrete up Mountain

🖼️ A Picture is Worth a Thousand Words

The World’s 50 Most Valuable Private Companies in 2025

Peak Population: When It’ll Hit the World’s 40 Largest Countries

We hope that you enjoyed this month’s newsletter. Please let us know what you enjoyed, or write back with any of your own news.

As always, we’re here for you.

See you next month,

Halcyon Financial Planning